With long tail spend accounting for a mere 5% of a company’s procurement budget, procurement departments very rarely implement organisational processes tailored to this type of procurement in their supply chain. As a result, they have less insight into expenditure relating to these purchases, despite them accounting for up to 70% of hidden costs[1]. This is why it is essential for businesses to incorporate supplier rationalisation into their procurement policy to optimise their long tail spend, all while bringing supplier risks under control.

Multiple suppliers dispersed throughout the business

The growing needs and requirements of businesses and their internal stakeholders have led to a substantial enrichment of supplier databases in the supply chains over the years. As such, long tail spend (often grouped with indirect procurement and non-production procurement) represents on average 75% of a company’s suppliers[1].

Depending on the type and size of the business, this can represent hundreds if not thousands of suppliers often used on an exclusively local basis, or for several yearly transactions. Every business categorises them in their own way: dormant suppliers, local suppliers, suppliers on probation periods, etc. Not to mention the share of maverick spend placed with non-listed suppliers!

This multitude of suppliers for a supply chain not only represents significant administrative costs and widespread risk, it also generates a considerable amount of work for teams (increased single-line orders, suppliers sourcing and listing, etc.) In this context, it is essential to implement a strategic sourcing to reduce the number of suppliers.

Undervalued indirect costs

Non-negligible administrative costs arise when a business’s supply chain deals with many suppliers. These costs largely fall into two categories.

Supplier management costs

Valued at an average of €1,000 (approx. £855) per year, per supplier (this may vary depending on the business sector), these costs cover both listing and maintaining suppliers in a company’s database.

Subscriptions to services specialised in managing supplier risks are included here. These platforms enable businesses to gain insight into supplier solvency, verify provision of compulsory documentation, find out about their extra-financial performance, etc.

Transactional costs

Increased suppliers means increased transactions. Remember that on average, long tail spend accounts for 60% of a company’s order volume. This represents order forms and invoices that need to be managed by staff, for which costs rise to €95 (approx. £80) (for a traditional process) and €19 (approx. £16) per transaction (for a fully dematerialised process, such as e-procurement, e-ordering or e-invoicing solutions)[1].

This observation highlights the importance of rationalising your long tail spend supplier portfolio. While these hidden costs may appear insignificant on the surface, when correlated with the number of suppliers and transactions implicated, they represent considerable sums of money.

Quantitative and qualitative benefits

Undertaking supplier rationalisation for a business' supply chain reduces supplier portfolio management work and enables all transactions to be standardised. Teams become more efficient as a result: time spent on supplier consultation and selection phases, negotiations and processing orders and invoices is decreased.

Above all, significant savings are achieved thanks to the reduction of supplier management costs, rationalised transactions, and accelerated digitalisation of transactions.

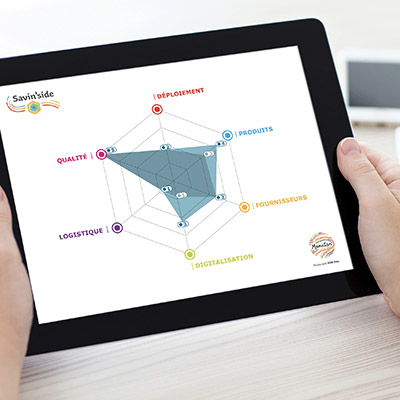

Considerable gains in terms of performance may also be observed:

- Environmental: supplier rationalisation naturally results in delivery rationalisation, as such reducing the number of lorries on the roads and associated greenhouse gas emissions.

- Social: teams are happier at work due to being able to focus on other projects with higher added value.

Lastly, in addition to the above non-negligible financial, environmental and social gains, procurement departments are also presented the opportunity to strengthen their supplier partnerships: improving risk management, supplier performance and service quality and enhancing value creation becomes possible. As a result, departments have the opportunity to take on new, more strategic projects, such as enhanced risk analysis, innovation, and development of a sustainable procurement policy.

Reducing the number of suppliers and the resulting administrative costs to achieve economies of scale is a well-known strategy among procurement departments. All the more so since implementing this type of project doesn’t require many resources, particularly when businesses are supported by a partner-supplier experienced in optimising this type of procurement.

However, this strategy reaches far beyond simple cost savings for the supply chains. It allows an optimisation of businesses expenditure, while improving team productivity, contributing to their CSR strategy and strengthening partnerships with their strategic suppliers.

As such, supplier rationalisation is the first step towards ensuring optimal management of the long tail spend in the supply chain, as well as identifying the procurement function which, let’s not forget, plays a major role in favour of internal customer satisfaction, effectiveness and profitability of a business.

The time has come to transform procurement function: directing focus towards projects with higher added value and strengthening its strategic positioning regarding other departments.

- Download our white paper ‘Rationalise your supplier portfolio’

[1] Manutan Group, internal data

_1110x555.jpeg)