Coming into effect on 1 January 2024, the Corporate Sustainability Reporting Directive (CSRD) has undoubtedly changed the landscape for publishing environmental, social and governance (ESG) information. The European directive has introduced an innovative approach to impact assessment: double materiality. As large companies accelerate their efforts to engage in ecological transition and ensure their compliance with these new requirements, they must now fully grasp this key concept.

Materiality: A financial concept

Originally, materiality was defined by the US Generally Accepted Accounting Principles as "an accounting principle according to which all elements that are reasonably likely to influence investors' decision-making must be recorded or presented in detail in a company's financial statements."

In other words, materiality aims to identify accounting information that could impact a company's financial performance. Information becomes material when it exceeds a certain threshold beyond which investors' decisions may be influenced. This requires companies to report on the most relevant issues for their activities, namely topics identified as material.

Sustainable development stakeholders have gradually adopted this key concept, particularly through the Global Reporting Initiative (GRI). Within companies, this takes the form of a materiality matrix that helps identify and prioritise their issues as part of their Corporate Social Responsibility (CSR) strategy.

What is double materiality?

Double materiality is now an essential concept in the field of sustainability and corporate responsibility. But what exactly is it?

Definition

Double materiality, also known as "dual materiality", pursues the same objective: to identify a company's key issues that can influence financial stakeholders' decisions.

However, it takes into account an entirely different dimension. Previously focused solely on financial performance, the reporting exercise based on double materiality now integrates social and environmental issues. This allows for a comprehensive assessment of the entire value chain's performance of a company in terms of sustainability.

Companies must consider two distinct perspectives, both dependent and interdependent, in their sustainability reporting: financial materiality and impact materiality.

Financial materiality

Financial materiality, or simple materiality, refers to risks and opportunities that impact the business's financial performance. It describes the impact of the environment on the company (outside-in). In other words, this perspective examines how environmental and social matters affect the company's financial performance.

Impact materiality

Impact materiality, or non-financial socio-environmental materiality, focuses on the company's impact on the environment (inside-out). More specifically, this perspective concentrates on the negative and/or positive impacts of a business's activities on its economic, social, and natural environment.

The challenge is to identify the potential issues facing the company, assess their materiality, and prioritise them. Issues identified as major for all stakeholders must then be addressed as a priority.

CSRD: The framework for double materiality analysis

Previously, companies were relatively free to choose the information to disclose and the methodology used in their reporting exercise. The CSRD now aims to better regulate companies' non-financial reporting by defining a specific regulatory framework for conducting double materiality analysis.

Sustainability standards (ESRS)

To conduct their double materiality assessment process, companies rely on the European Sustainability Reporting Standards (ESRS). These standards specify the information that companies must provide. Divided into themes and sub-themes, they address climate change, pollution, human resources, end customers, business conduct, and more. This helps companies identify topics to address, define the scope of their analysis, and set clear objectives to achieve.

Stakeholder involvement

Companies must identify internal and external stakeholders affected by their activities. It is also beneficial to consult them through collective workshops, individual interviews, questionnaires, etc. Although this is optional under the CSRD, it remains recommended. This may include stakeholders who are impacted, potentially impacted, and/or able to testify to the consequences of the business's activities.

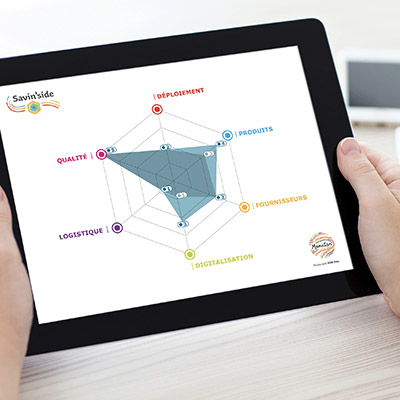

Choice of format

Companies are free to present the results of their double materiality analysis as they wish. However, the use of a double materiality matrix is particularly widespread, with materiality on the x-axis and impact materiality on the y-axis.

The CSRD requires each business to conduct its own double materiality analysis following these general principles and adapting it to its own reality, i.e., its sector of activity, size, and business model.

-

16% of companies have already conducted a double materiality analysis;

-

31% of respondents indicate they have never conducted an analysis of their CSR risks;

-

56% state they have never involved their stakeholders in assessing the materiality of ESG issues.

This paves the way for a reporting strategy adapted to companies and future challenges. This is how organisations can meet the growing expectations of regulators and their stakeholders, as well as seize opportunities to innovate, reduce risks, and create sustainable value.