Last May and June, Acxias et Ressource Consulting conducted their 3rd annual survey on indirect procurement. The findings, presented at the Conférence des Achats Indirects on 27 June, shed light on the current challenges and practices of Procurement departments when it comes to indirect procurement.

Indirect procurement is becoming a priority

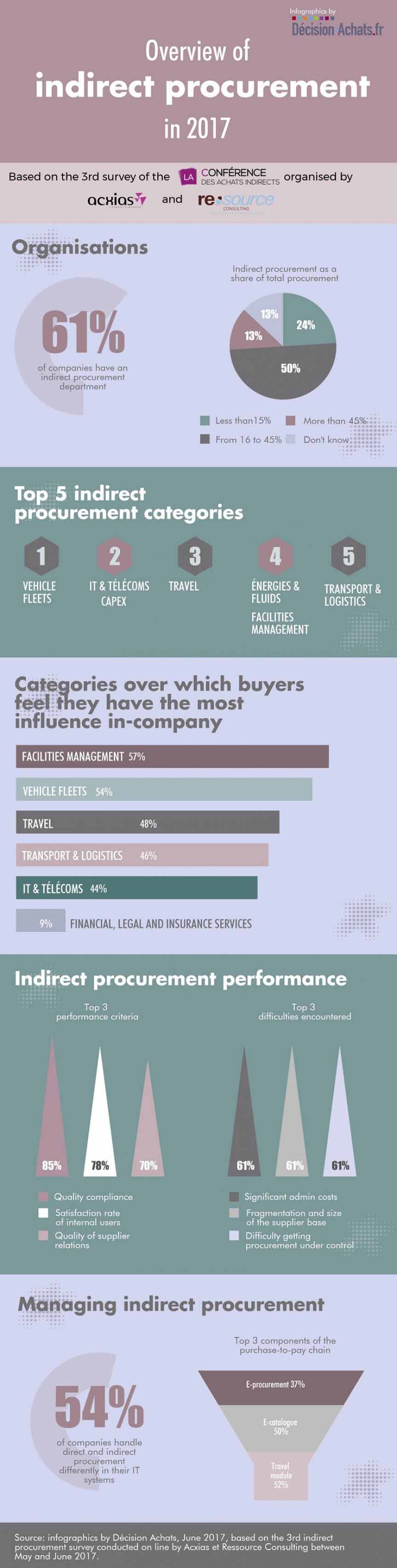

60.1% of respondents indicate that their company has an Indirect Procurement department. This figure is up 16 points on last year, proof that indirect procurement is starting to become a priority.

This trend is confirmed: for 84% of respondents, systems are in place to manage indirect procurement (i.e. it has been the focus of recent actions, is already managed, or is managed in the same way as production procurement). For only 15.2%, indirect procurement is not (yet) a priority.

Very diverse procurement categories

The priority procurement categories vary in line with each company’s core business, but some trends do nonetheless emerge. For our respondents, the top 5 procurement categories in terms of importance are:

- Vehicle fleets (cars, forklifts, HGVs, etc.)

- CAPEX (property / equipment, etc.)

- Travel (taxis, flights, trains, hotels, travel agencies, etc.)

- Facilities management (leasing, cleaning, security, green spaces, catering)

- Energies & fluids (electricity, fuels, water, gas, heating, etc.)

However, these are not the only procurement categories that Procurement departments believe they can act upon with regard to internal prescribers and users. There are also:

- Facilities management (leasing, cleaning, security, green spaces, catering)

- Vehicle fleets (cars, forklifts, HGVs, etc.)

- Travel (taxis, flights, trains, hotels, travel agencies, etc.)

- Transport & logistics (storage of bought-in products / WIP / finished products, grouping/ungrouping, allotment, etc.)

- IT & telecoms (hardware, software, telecommunications, etc.)

Goals and challenges for today and tomorrow

The performance criteria have evolved since last year. Contract savings no longer seem to be a priority, moving down to 5th place, overtaken by quality and by supplier relations. Creating a genuine customer/supplier partnership pays off!

The top 3 expectations expressed are:

1 - Quality compliance

2 - Satisfaction rate of internal users

3 - Quality of supplier relations

In parallel, respondents shared their specific indirect procurement concerns, ranked in order of importance:

1 – Significant admin costs

2 – Fragmentation and size of the supplier base

3 – Difficulty getting procurement under control

4 – Prevalence of rogue buying

5 – Lack of dedicated IT tools