When it comes to indirect purchases, especially rogue buying, it is important to look at the total cost of ownership (TCO) related to the purchase. Even though these are often considered trivial purchases, users have a tendency to deviate from the process defined by the company's Purchasing Department, resulting in an increase in hidden costs. In this sense, rogue buying offer many opportunities for potential savings.

The beginnings of rogue buying

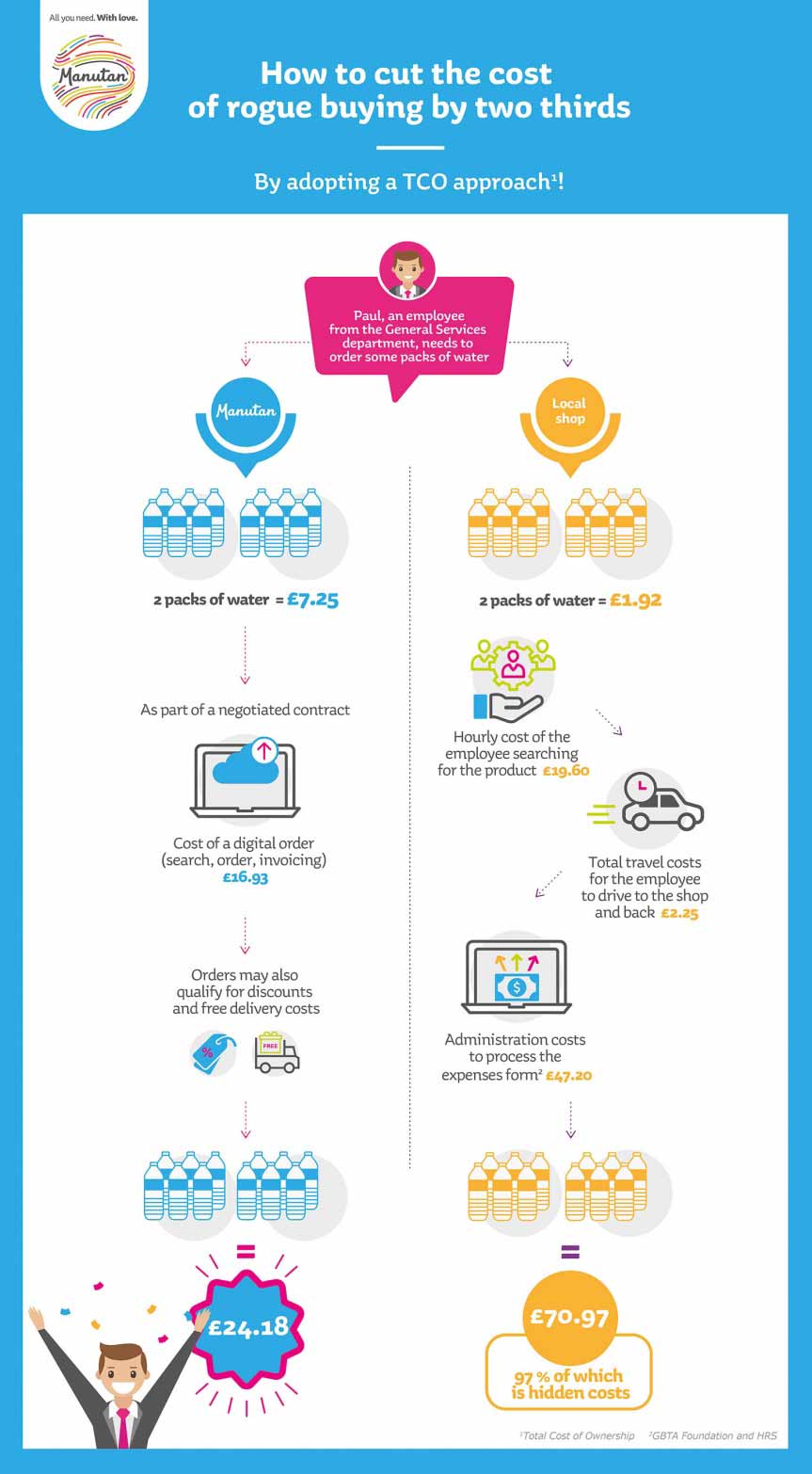

The two packs of water in this infographic could be used as an example for any rogue or "ad hoc" purchases of items such as adjustable wrenches, reams of paper or gloves. What these purchases all have in common is the fact that they are made outside of the buying process, often as a matter of urgency. Furthermore, Purchasing Departments unfortunately have no control over this type of purchase.

A scenario where a user needs a product such as bottled water for an event is common for many companies. However, the user decides not to respect the process put in place by the Purchasing Department (logging on to the online catalogue, choosing from listed suppliers etc.).

There could be many reasons for this. Perhaps the user is not familiar with the process, or thinks that buying the cheapest bottled water in the local supermarket works in the company's favour. The user may even be friendly with the shopkeeper, so prefers to go to the shop instead.

However, there are just as many reasons against rogue buying, as rogue buying often mean hidden costs.

97% of the TCO is made up of hidden costs

Rogue buying that deviate from the process incur additional costs, which the user does not necessarily take into account and which could be avoided:

- £19.60 in labour costs

The user spends an hour deciding where to buy the bottled water from, before getting in the car, buying the product and returning to work. The worker's average hourly rate is £19.60 (including charges).

- £2.25 in transport costs

The user has used his car to make this purchase and would like claim his mileage. A 3 mile trip costs £2.25, with a mileage allowance of £0.75/ Mile.

- £47.20 in administration costs

The user would also like to claim expenses and sends an expenses form to the accounting department. On average, processing an expenses form costs £47.20*. This calculation does not even take into account that the average error risk is 19%, which can cost an additional £42.75.

In the end, this is a big bill. Like typical rogue buying, packs of water bought outside of the process incur additional costs, resulting in a total cost of acquisition of £70.97, 97% of which is hidden costs.

Meanwhile, packs of water could have been purchased from a listed supplier and using a digitalised transactional process, costing just £24.18 in total.

With these figures in mind, it is time to get these rogue purchases under control.

Click here to find out more about hidden costs

* GBTA Foundation and HRS

Download