Suppliers are central to the long-term performance and success of any company. Given the increasing complexity of global supply chains, it seems essential to adopt effective supplier relationship management. This is the responsibility of the Procurement Department and involves setting up an SRP (Supplier Relationship Portal) based on supplier segmentation.

Supplier segmentation to initiate the approach

Any SRP (Supplier Relationship Portal) approach starts with supplier segmentation. This involves sorting a company’s supplier portfolio into categories (or segments) based on their level of criticality and financial impact on the company. Each category is then assigned a tailored strategy.

A supplier classification method that is particularly widespread in the world of procurement is the Kraljic matrix. Companies can segment their suppliers into different categories: Strategic suppliers, preferred suppliers, developing suppliers, probationary suppliers, local suppliers, dormant suppliers, potential suppliers, etc. This is how companies build up their supplier panel.

Setting up an SRP in three phases

After a supplier segmentation phase, procurement departments focus on implementing the SRP. This technology aims to manage and develop long-term relationships with suppliers in a "win-win" perspective. Each party wants to achieve its commercial objectives, in line with its overall strategy. To achieve this, any SRP relies on three essentials.

1. A governance framework

To structure the framework governing supplier relationships, it is advisable to appoint someone responsible for day-to-day supplier management, as well as the various parties involved in the company’s operations (internal users, management, etc.).

2. Key performance indicators

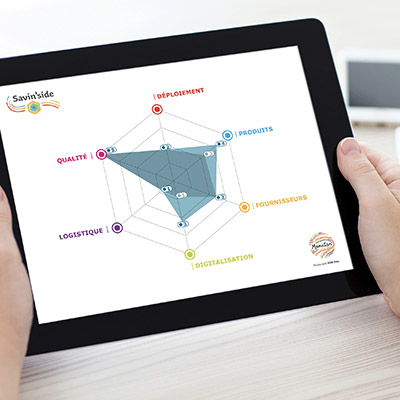

Then, it is important to define parameters to measure the success of each supplier relationship. Key performance indicators vary according to supplier categories. They may include lead times, savings, compliance rate, etc.

3. A clearly defined strategy

Finally, it involves defining a procurement strategy tailored to each supplier category. In other words, companies can maximise the added value of their strategic suppliers, minimise the risks associated with critical suppliers and limit the costs of purely transactional suppliers.

Here are some detailed examples:

· With their strategic suppliers, buyers will want to build loyalty, for instance by accelerating innovation or improving product and service availability.

· With probationary suppliers, they will focus more on securing inventory.

· With local and/or dormant suppliers, it will be more about substituting them in favour of reference distributors.

SRP: A key optimisation lever

Supplier segmentation, followed by implementation of an SRP, has two main benefits, which are interdependent.

Improved performance

This shared strategy, combined with real commitment from both parties, is a tremendous lever for not only improving supplier performance, but also procurement performance. Procurement departments can enhance process efficiency, reduce inventory and lead times, improve internal customer satisfaction, gain responsiveness, improve end product quality, facilitate access to innovations and new products and markets, etc.

Reduced risks

At the same time, such an approach also reduces supplier risk, whether in terms of product quality, material availability, price fluctuations, supply chain continuity or corporate reputation, for example.

(Inset) An SRP generally goes hand in hand with SRM software. It streamlines all procurement processes (sourcing, tendering, contracting, performance monitoring and evaluation) by automating data collection and analysis. Such a tool also promotes more transparent, real-time communication with trading partners, thus leading to better coordination of activities.

The importance of data in such an approach

When using an SRP, managing and analysing supplier data is key. To fully benefit from it, companies first need to be able to centralise and ensure the reliability of a set of raw data (administrative, legal, financial and contractual information, but also relating to products, performance, quality, etc.). This is precisely what SRM software is used for. This type of solution speeds up and improves the collection of information from various sources (order system, internal customers, suppliers, public databases, rating platforms, etc.).

In addition to aggregating data, this category of tools also enables the creation of automated dashboards and analysis reports. Procurement departments can then rely on this data for various purposes:

· Internal and external reporting;

· Risk analysis;

· Preparation for negotiations;

· Implementation of improvement plans;

· Etc.

Data thus proves to be a powerful tool to help companies optimise supplier segmentation and feed their SRP.

As you can see, supplier segmentation combined with an SRP allows companies to think about and build their partnership relationships in an informed manner, thereby incorporating them into a process of mutual progress. Using such an approach, organisations can better manage and even optimise supplier relationship management, and thus their procurement strategy. Now that companies have understood the benefit of being a preferred customer for their suppliers, improving their relationships with them makes complete sense.

_1110x555.jpeg)