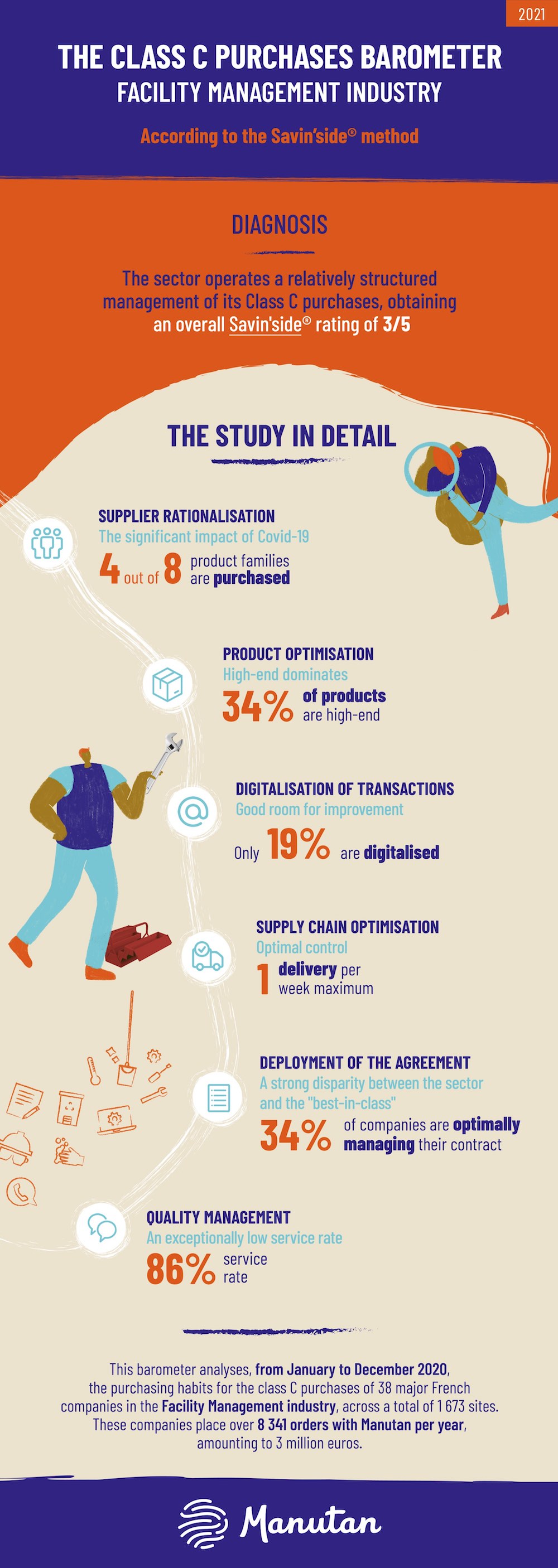

Having analysed the management of tail spend in the construction, transport and storage industries, Manutan has carried out its latest barometer on facility management. Using the Savin'side® method, the purchasing habits of 38 major French companies have been scrutinised across six key areas. With an overall Savin'side® rating of 3/5, the sector shows good overall performance. However, despite performing well in terms of logistics, further improvements still need to be made in two major areas: supplier portfolio streamlining and transaction digitisation.

Focus no. 1: Supplier streamlining

French facility management companies aren't taking full advantage of what Manutan has to offer, primarily purchasing products from just four out of eight categories: security, warehouse, office and hygiene. As a result of the health crisis, PPE and hygiene equipment have been purchased extensively, so much so that these protective products account for 15% of the sector's turnover over the period from January to December 2020.

Focus no. 2: Product optimisation

In the facility management sector, companies mainly purchase high-end products. This trend has once again been impacted by the COVID-19 crisis. With logistics chains disrupted, companies have not always been able to select a suitable product pricing range. By contrast, the purchase of high-end products by [1]best-in-class companies is almost half compared to the industry average.

Focus no. 3: Transaction digitalisation

Although facility management companies have begun to introduce digital transformation, there is still room for improvement in terms of digitising their own procurement processes. In fact, only 19% of the sector's transactions are paperless, while best-in-class companies are digitising almost one in two transactions (46%).

Focus no. 4: Logistics optimisation

One of the sector's real strengths is that companies never exceed more than three deliveries of tail spend per week at each site. This is a promising finding for the sector, as emergency performance remains one of the industry's biggest challenges.

Focus no. 5: Agreement implementation

In our evaluation, only 34% of companies make full use of the terms of their contract, meaning their expenditure per employee each year is higher than the industry average (€89). With a stronger commitment to digitising their processes, the best-in-class companies achieved a rate of 67%.

Focus no. 6: Quality control

The facility management sector has a service rate of 86%, while the best-in-class companies scored an additional 11 points. The sources of insufficient quality identified were predominantly related to:

- Delivery times and product errors, as a result of COVID-19.

- Billing errors, underlining the importance of introducing paperless invoices.

Despite the inevitable impact of the pandemic, facility management companies take a relatively structured approach when it comes to managing their tail spend. There are two key areas to prioritise in order to further reduce and bring unscheduled purchases under control: streamlining the supplier portfolio for product categories that have already been optimised and digitising transactions using an e-procurement solution.

[1] Best-in-class companies represent the top 20% best-performing organisations across all six levers examined as part of our Savin'side® evaluation.