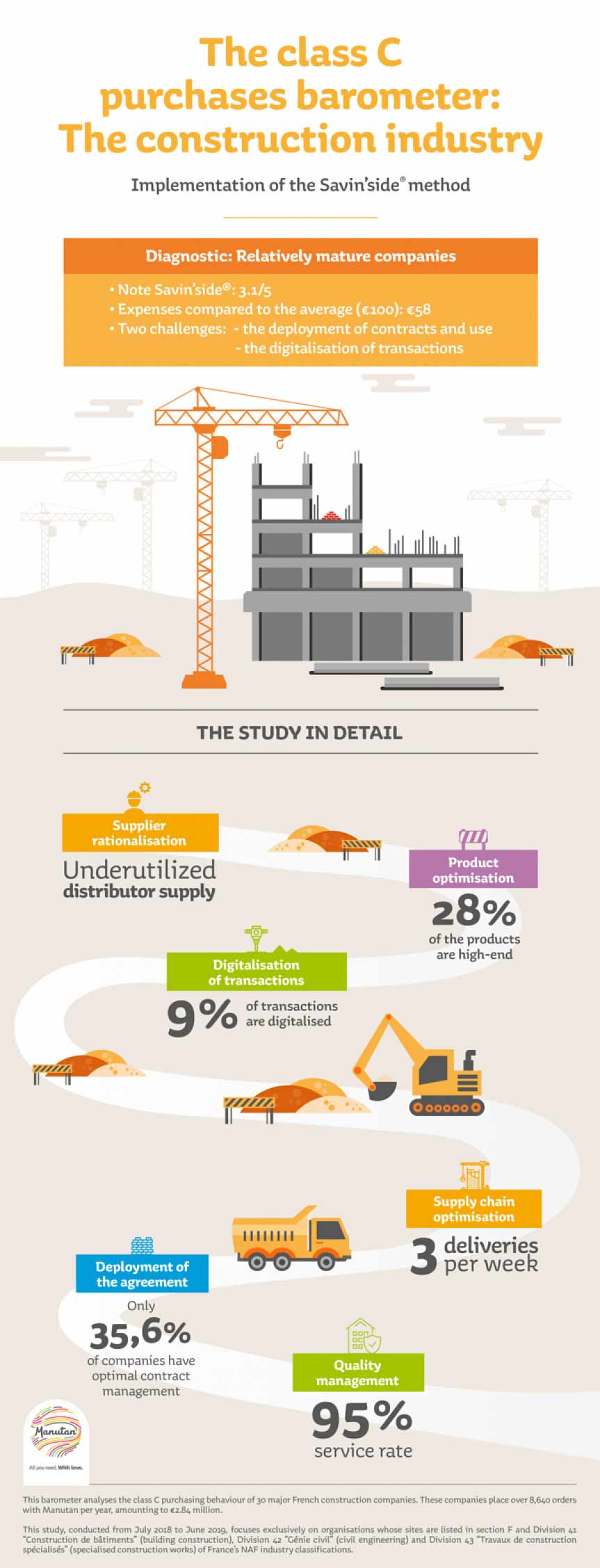

The latest study on tail spend [1] shows the level of optimisation for tail spend by companies in the construction industry. Using the Savin'side® method, this study analyses the management of tail spend by companies on the panel using six levers for a competitive advantage, and gives an average Savin'side® rating of 3.1/5 for the construction sector. However, real improvements are still needed for two of the six levers analysed, specifically:

- Compliance with contracts

- Digitalisation of transactions

Find out more about the state of play for tail spend management in the construction sector, summarised in an infographic...

Assessing the maturity of construction companies in managing their tail spend, by rating them on the six Savin'side® levers for a competitive advantage:

1. Supplier rationalisation: 3/5

Only three of Manutan's seven product families are actually purchased by construction companies. This means that construction companies under-exploit the breadth of the offers available from their distributors. Yet streamlining supplier portfolios by using partner distributors is essential for optimising the management of tail spend.

2. Product optimisation: 3/5

In the construction sector, high-end products make up 28% of the product mix. These premium purchases, which both reassure and satisfy users, must be optimised in order to prevent the required quality level from being exceeded, and in order to adapt purchases to the real needs of companies, thus optimising tail spend.

3. Digitalisation of transactions: 1/5

The level of digitalisation within the construction industry is very low, with an average transaction digitalisation rate of 9%. This is as much due to the limitations of the working environment on construction sites, as to the difficulty of implementing a purchasing solution adapted to the various information systems within the same company.

4. Supply chain optimisation: 5/5

The construction industry never exceeds more than three deliveries per week. This highlights the good practice of users who group their tail spend and limit the use of multiple trucks.

5. Deployment of the agreement: 2/5

Only 36% of the sites studied make optimal use of their contracts. Deploying framework agreements remains one of the major challenges in the sector. To achieve this, companies must focus on:

- Digital solutions adapted to the constraints of the sector.

- Tailor-made marketing campaigns to win over customers.

6. Quality management: 4/5

The construction industry has a good service rate of 95%. A positive result that can be explained, again, by the fact that users tend to group their purchases together and/or place urgent orders, meaning that transactions can be better monitored.

The final word on this comes from Karima Brahmi, National Key Account Manager for the Construction Industry at Manutan: "Buyers position themselves as the real 'Construction Site Manager'. With an ear to the ground, they see themselves as a business facilitator in a constantly changing industry. Buyers compare the specific needs of construction sites with the financial and strategic issues of the group, seeking first and foremost to improve visibility and encourage internal customers to work with the company's procurement strategy. Digitalisation represents a significant lever in response to all of these challenges, despite disparities between resources available in the field".

- For more details, download the complete tail spend barometer for the construction industry

[1] This study analyses the tail spend behaviour of 30 major French construction companies. These companies place over 8640 orders with Manutan per year, amounting to 2.84 million euro.

This study, conducted from July 2018 to June 2019, focuses exclusively on organisations whose sites are listed in section F and Division 41 "Construction de bâtiments" (building construction), Division 42 "Génie civil" (civil engineering) and Division 43 "Travaux de construction spécialisés" (specialised construction works) of France's NAF industry classifications.