A procurement strategy is based around three key steps:

- Prioritising the financial significance of purchases

- Identifying the level of risk that purchases present

- Determining priorities based on the procurement matrix

1. Prioritising the financial significance of purchases

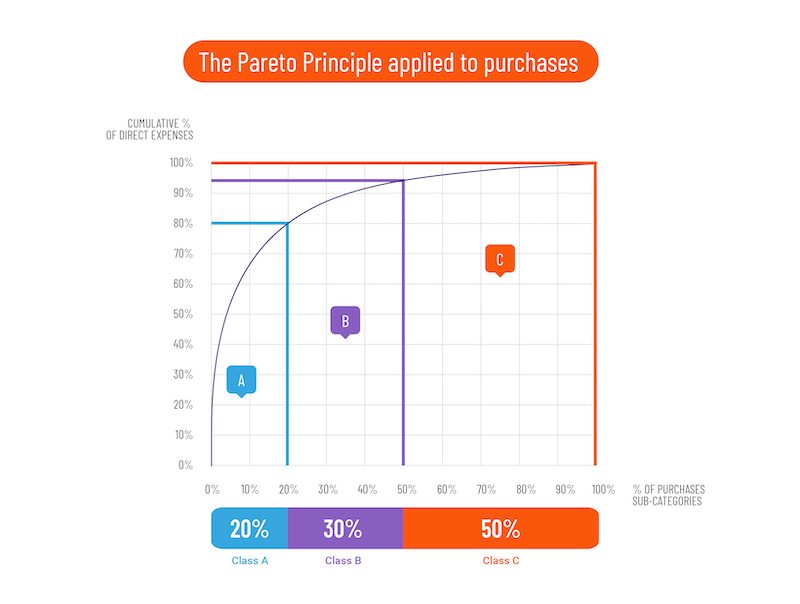

The Pareto Analysis is used to prioritise the financial significance of purchasing segments (or purchasing sub-categories) based on annual expenditure within the company.

Purchasing segments are listed in order of decreasing expenditure amounts. The total expenditure amount is determined, as is the share of each segment as a percentage of these total amounts. The Pareto Curve can then be drawn.

This gives us three classes of purchases which, in most companies, are distributed as follows:

- Class A purchases represent 20% of the total number of purchasing segments and account for 80% of a company's total expenditure.

- Class B purchases represent 30% of the total number of purchasing segments and account for 15% of expenditure.

- Class C purchases as known as tail spend represent 50% of the total number of purchasing segments and account for 5% of expenditure.

This does not mean that the class C purchasing segment is unimportant, even though it only accounts for small amounts.

These two key points need to be considered:

- High hidden costs: Even though class C purchases so-called tail spend only involve small amounts, the associated management costs are the highest of all the purchasing categories (A and B). This is because they total the highest number of items purchased (up to 85%), suppliers (up to 75%), orders (up to 60%) and complaints (up to 60%) (source: Manutan).

- A level of criticality that should not be overlooked: A low purchase amount is often confused with a low level of criticality. However, this is not true. Let's take a look at a few examples. For instance, in the PPE (Personal Protective Equipment) segment, poor-quality cut-resistant gloves can lead to accidents at work. Meanwhile, in the "office equipment" segment, the ergonomics of an office chair play a crucial role in terms of musculoskeletal conditions, as well as "well-working" from an employee perspective. Standardisation is also required in certain categories, with CE markings, for example.

As well as looking at the financial significance of purchases, their level of risk must also be considered.

2. Identifying the level of risk that purchases present

Risk assessments of purchasing segments differ from company to company. These are set in motion by buyers who work closely with affected stakeholders, such as users and advisers. For a concrete analysis, we recommend using a scale from 0 to 10, ranging from "very low" to "very high" risk.

The aim is to have as comprehensive a view as possible of the risks for each segment. We suggest having seven key risk categories to consider. Buyers may add or remove categories depending on their company's strategy. For each segment, they can calculate a mathematical average. They can then weigh up certain risks based on the company's strategic priorities.

|

Risk category |

Description |

Rating from 0 to 10

|

|

1. Risks related to the end customer |

|

|

|

2. Technical and technological risks |

|

|

|

3. Risks related to services and solutions |

|

|

|

4. CSR risks |

|

|

|

5. Specific financial risks |

|

|

|

6. Supply chain risks |

|

|

|

7. Risks related to the supplier market |

|

|

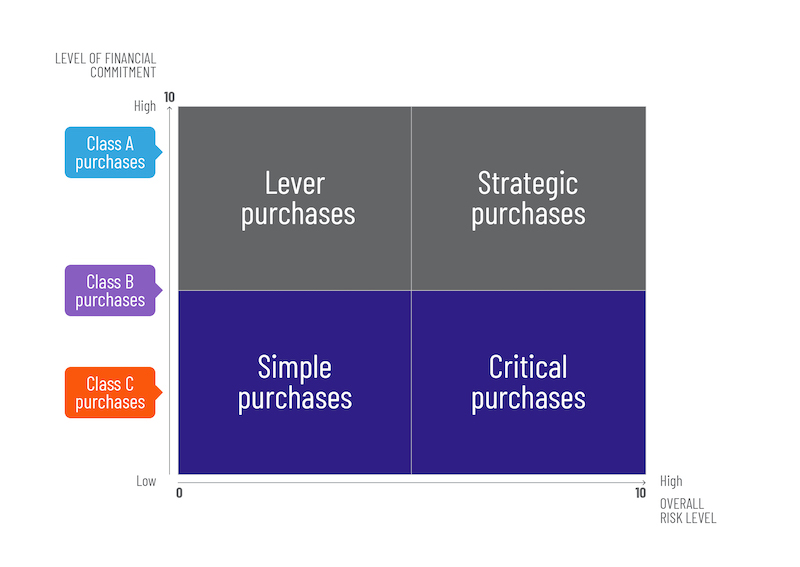

3. Determining priorities based on the procurement matrix

Thanks to the two previous analyses, the buyer is aware of:

- The financial significance of the purchasing segments

- The level of risk associated with purchasing segments

By cross-referencing these two analyses, buyers can find the two main areas of their decision-making purchasing matrix. This purchasing matrix is inspired both by Kraljic's work and our own observations of companies.

Through this matrix, we can see that class C purchases alias tail spend can be "simple" or "critical".

- For simple purchases, the priority is to reduce hidden costs, in the form of administrative and logistical costs. In most cases, these hidden costs are higher than the face value of the purchased item. The number of suppliers, orders, invoices and deliveries therefore needs to be reduced. With this in mind, holding contracts with just a few suppliers who are able to provide a broad, online range is key. The entire process, from ordering through to invoicing, must be digitalised, and the user experience made easier (for example, by implementing a PunchOut). In addition to a digitalised range, the selected suppliers must be able to offer optimised logistics flows by grouping orders together, offering on-site vending solutions and so on.

- For critical purchases, security is the priority. Just like with simple purchases, holding contracts with just a few suppliers who each have a broad, digitalised range is fundamental. However, choosing suppliers who are able to guarantee the origin of products is essential, as is their ability to comply with standards and regulations and provide declarations of conformity for the products. In addition to legal risk, the company must also be protected from reputational risk, whether from a customer or employee perspective. Many class C purchases alias tail spend, unlike class A and B purchases, are used by employees (office and workshop furniture, PPE, tools etc.). Making high-quality, ergonomic and eco-friendly products available, just to give a few examples, is one way to respect employees and ensure that they remain motivated and committed — essential for a successful company.

Wrongly considered as being low risk, and therefore not a priority, companies too often let tail spend fall by the wayside. However, they are central to optimisation and security issues. In our view, a well-thought-out strategy for tail spend is a good indicator of the maturity of the procurement department within a company.